Will McAfee

Residential Mortgages:

Loan Originator

Serving California.

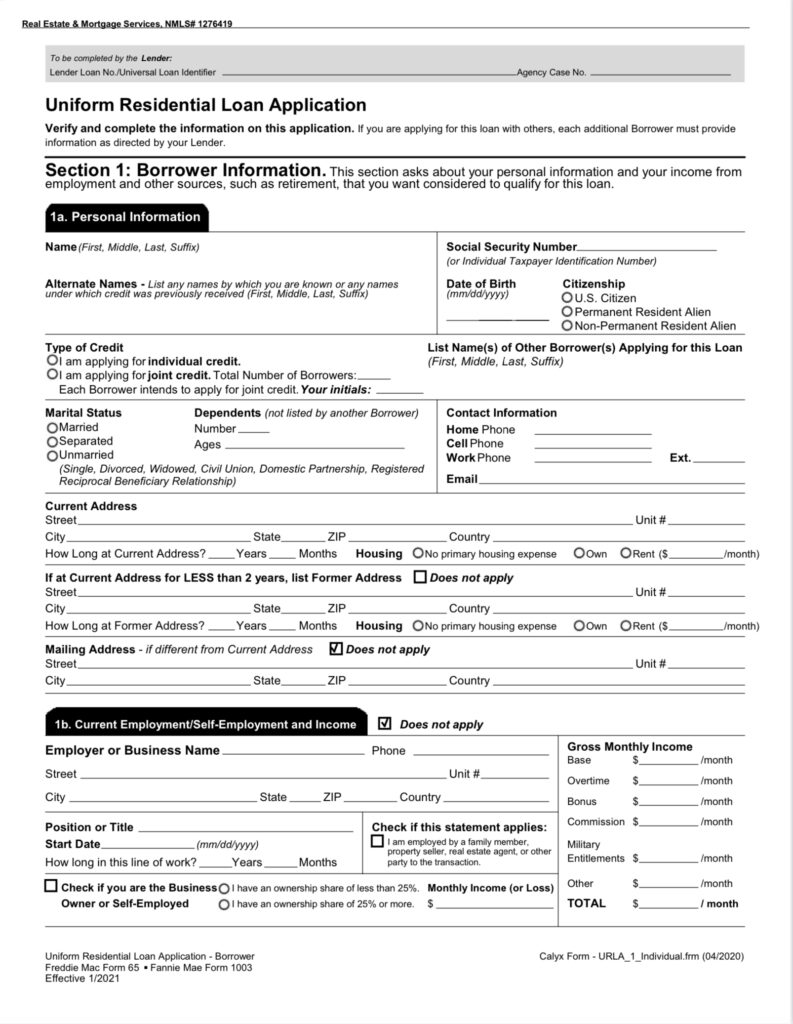

The first step in acquiring a residential purchase or refinance loan is to fill out the mortgage loan application.

After you download it from this website, I can help you fill it out over the phone. But first I will ask you some very important questions to get an idea what you want and what you can afford.

I can also give you an interest rate quote. Rates are determined by your LTV ( loan to value), FICO (credit) scores and other factors.

The questions will include:

1. What type of loan are you looking for: purchase or refinance? 30 yr fixed?

2. What is your current mortgage balance?

3. Do you know your FICO (credit) score?

4. Are you interested in getting some cash or just a better loan?

5. Do you know how much your home is worth and how much equity you have ?

6. What size monthly payments can you afford? You can use a mortgage calculator to determine monthly payments.

7. Do you have any installment loans such as car payments or student loans?

8. Do you have any Credit card debt? How much and what are your minimum payments?

After you fill out the application and we get a picture of your income, assets and liabilities, we can generally determine whether you can qualify for the loan type and amount you want.

Then comes the process of verification of those things.

If you work for an employer you will need to show 2 years of w2 statements and payroll stubs for the previous 30 days. If you are self-employed, provide tax returns-both personal and business.

You will need to provide all pages of your federal returns.(1040s,1065s w/k1s, 1120s (S Corp) whichever is applicable). Profit and loss statements may also be required.

Liquid assets can be verified through bank statements covering the prior 2 months.

Non liquid assets (those not easily converted to cash) will require the prior 2 month’s statements. Other assets such as IRAs -2 months.

If you have enough cash reserves (lenders like to see enough to cover two months of PITI- principle, interest, taxes and insurance payments), verification of other assets may not be required.

Download Mortgage Loan Application

R.E.M.S. NMLS# 1276419, DRE# 1356745

Will McAfee NMLS # 2072524, DRE 01178253

Serving all of California.

Whether purchasing a home or applying for a loan, Will McAfee can guide you through the California residential mortgages process to help you realize your dreams. Use our free resources and contact us with your questions.